san francisco sales tax rate 2018

Heres how that math works for Harborside. 0370 percent for gross receipts between 2500001 and 25000000.

San Francisco Adopts Major Changes To Business Taxes 2019 Articles Resources Cla Cliftonlarsonallen

San Gabriel CA Sales Tax Rate.

. San Jacinto CA Sales Tax Rate. In San Francisco transfer taxes upon change of ownership are typically paid by the Seller though it can be otherwise agreed to in the purchase contract. To avoid late penaltiesfees the return must be submitted and paid o n or before the last.

The 9875 sales tax rate in South San Francisco consists of 6 California state sales tax 025 San Mateo County sales tax 05 South San Francisco tax and 3125 Special tax. The San Francisco sales tax rate is 0. Next to city indicates incorporated city City Rate County Avalon 10000 Los Angeles Avenal 7250 Kings Avery 7250 Calaveras Avila Beach 7250 San Luis Obispo Azusa 9500 Los Angeles Badger 7750 Tulare.

850 Is this data incorrect The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxesThe local sales tax consists of a 025 county sales tax and a 225 special district sales tax used to fund transportation districts local attractions etc. While this tax was originally scheduled to phase out completely during 2018 it was retained at 038 percent because GRT revenue was lower than expected. Persons other than lessors of residential real estate ARE REQUIRED to file a Return for tax year 2018 if in 2018 you were engaged in business in San Francisco as defined in Code section 62-12 qualified by Code sections 9523 f and g were not otherwise exempt under Code sections 906 or 954 and you.

Had more than 300000 in taxable San Francisco payroll. San Joaquin Hills CA Sales Tax Rate. San Gregorio CA Sales Tax Rate.

The California sales tax rate is currently 6. The rate is adjusted periodically and for the 2018 tax year is 038 percent. San Joaquin CA Sales Tax Rate.

250 for each 500 or portion thereof. The tax is calculated as a percentage of total payroll expense based on the tax rate for the year. Fast Easy Tax Solutions.

The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375 Special tax. 2 Page Note. The County sales tax rate is 025.

Details Background Before 2014 San Francisco imposed a 15 percent payroll tax on businesses operating in the city. Effective April 1 2018 the following City sales tax rates will change. The brand new three-bedroom unit 215 at 555 Innes Avenue one of the 159 units within the second wave of development at the San Francisco Shipyard was priced at 910500 or roughly 728 per square foot back in June of 2016.

You can print a 9875 sales tax table here. For businesses engaged in providing accommodations utilities arts entertainment or recreation the following rates are applicable. The sales tax amounts in the interactive map above represent only the collections attributable to local Bradley-Burns portion of sales tax from 2011 to 2016.

The 2018 Payroll Expense Tax rate is 0380 percent. San Fernando CA Sales Tax Rate. 7 Gross receipts from a lease or sublease will be taxable at the following rates.

Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business annually by the last day of February for the prior calendar year Jan. The sales tax jurisdiction name is San Francisco Tourism Improvement District which may refer to a local government division. 6 Unlike Manhattan San Franciscos Commercial Rents Tax will be imposed on the landlord not the tenant.

0475 percent for gross receipts over 25000000. San Jose CA Sales Tax. San Geronimo CA Sales Tax Rate.

35 percent tax on gross. San Francisco CA Sales Tax Rate. The Payroll Expense Tax will not be phased out in 2018 as originally planned due to less-than-expected revenue from the Gross Receipts Tax.

More than 100 but less than or equal to 250000. This rate is made up of a base rate of 6 plus a mandatory local rate of 125. California City and County Sales and Use Tax Rates Rates Effective 04012018 through 06302018.

Ad Find Out Sales Tax Rates For Free. There is no applicable city tax. This is the total of state county and city sales tax rates.

2018 and potentially future years at a rate of 03820 Contacts. With the addition of locally approved county and municipal taxes the total combined sales tax rate can be as high as 1025 the highest in the United States. If you have questions regarding any San Francisco tax matters please contact either of the following Deloitte.

For a full historical description of sales tax rates and beneficiaries in San Francisco and. Reduced Sale Prices at the San Francisco Shipyard. The San Francisco Annual Business Tax Return Return includes the Gross Receipts Tax Payroll Expense Tax and Administrative Office TaxBeginning in tax year 2019 the Return will also include the Early Care and Education Commercial Rents Tax and Homelessness Gross Receipts Tax.

If entire value or consideration is X then the Tax rate for entire value or consideration is Y. Effective January 1 2019 San Francisco joins the New York City borough of Manhattan in imposing a commercial rents tax. And having been reduced to 875000 at the end.

For tax rates in other cities see. In our shop here the tax rate has gone from 15 percent all the way up to almost 35 percent for adult consumers DeAngelo told KPIX 5. 0300 percent for gross receipts between 0 and 1000000.

The minimum combined 2022 sales tax rate for San Francisco California is 863.

Sales Tax Collections City Performance Scorecards

San Francisco Suspends Cannabis Tax To Combat Illegal Marijuana Sales Cbs San Francisco

At What Income Level Does The Marriage Penalty Tax Kick In

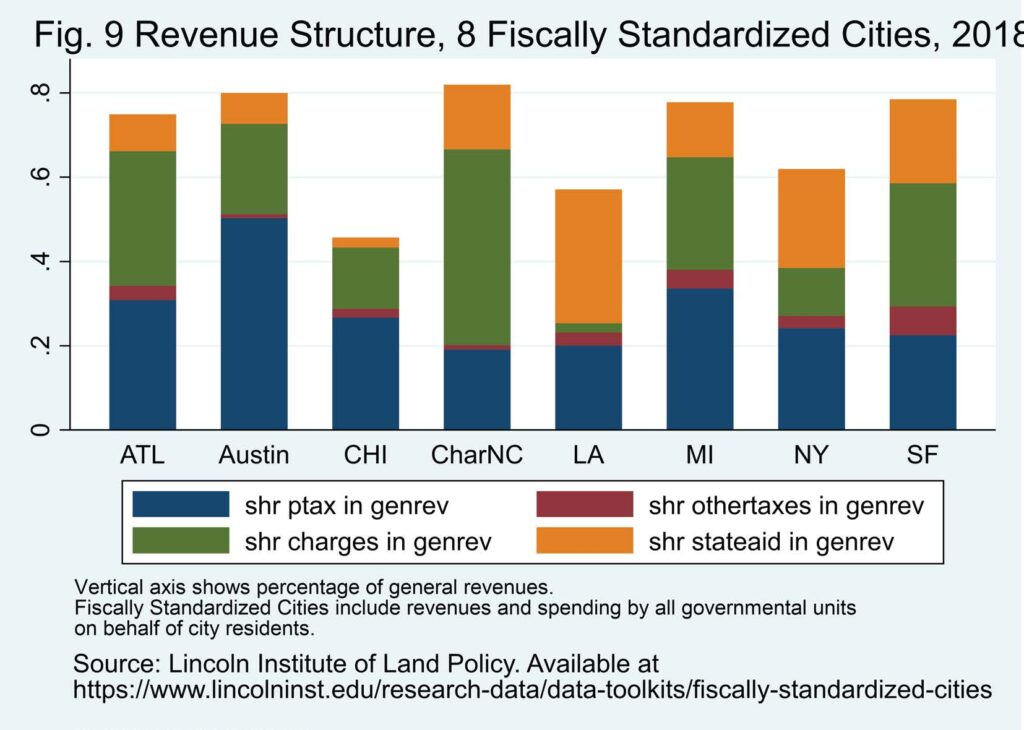

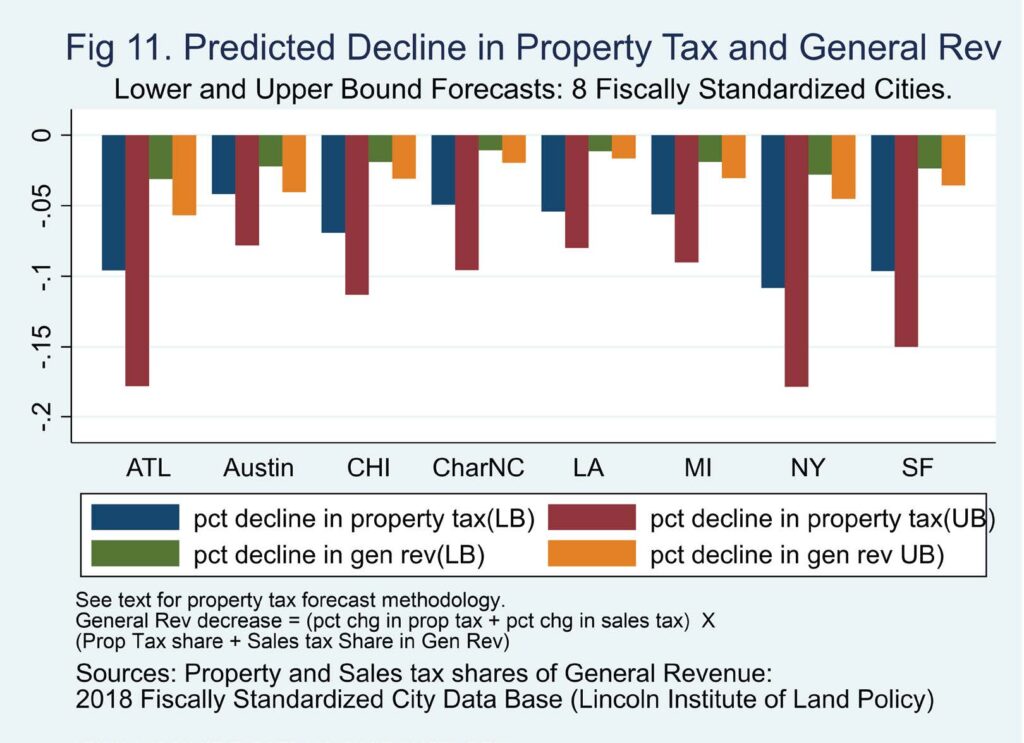

The Impact Of Work From Home On Commercial Property Values And The Property Tax In U S Cities Itep

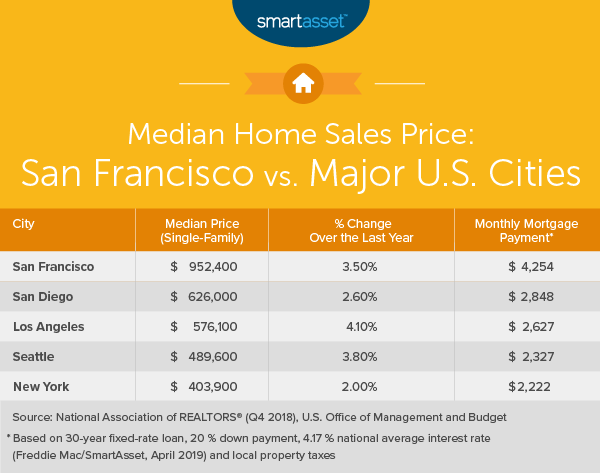

What Is The True Cost Of Living In San Francisco Smartasset

The Impact Of Work From Home On Commercial Property Values And The Property Tax In U S Cities Itep

Legal Stuff In San Francisco Sewmeimei

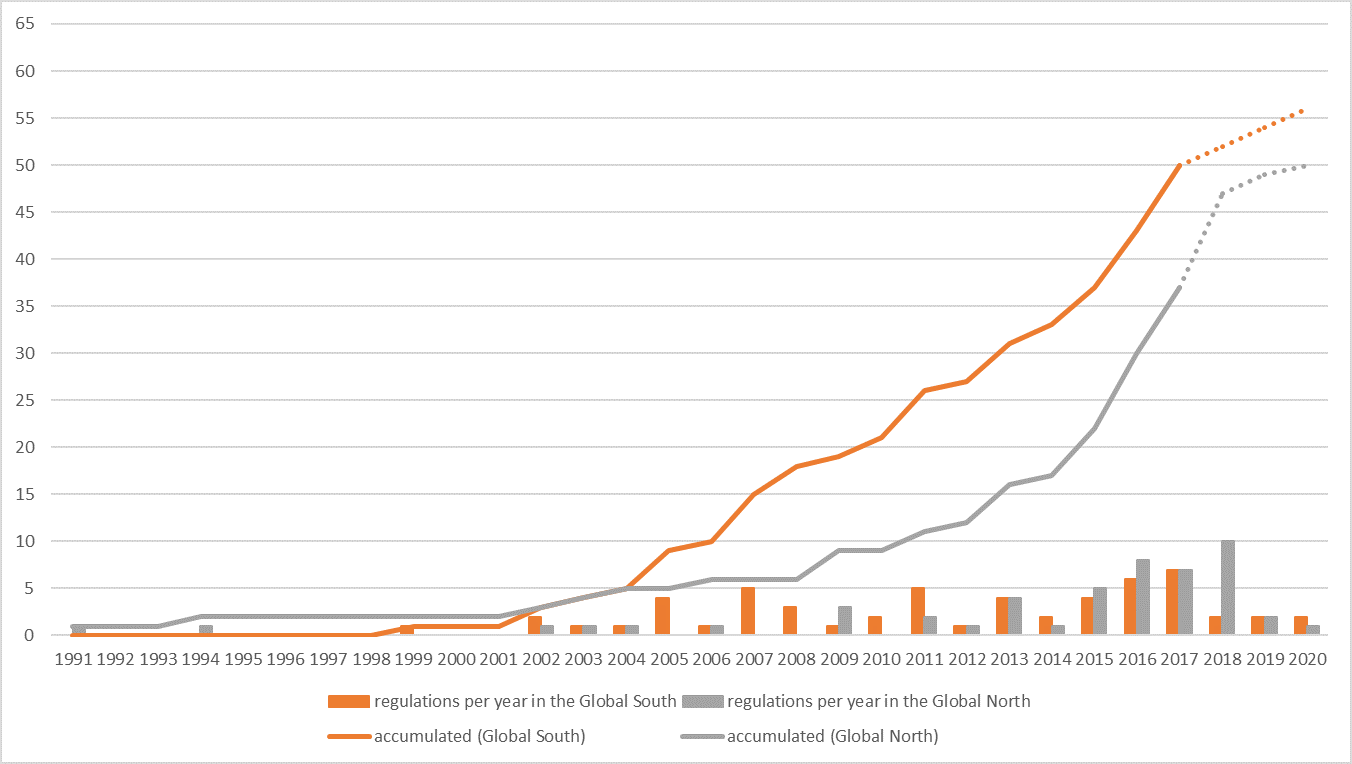

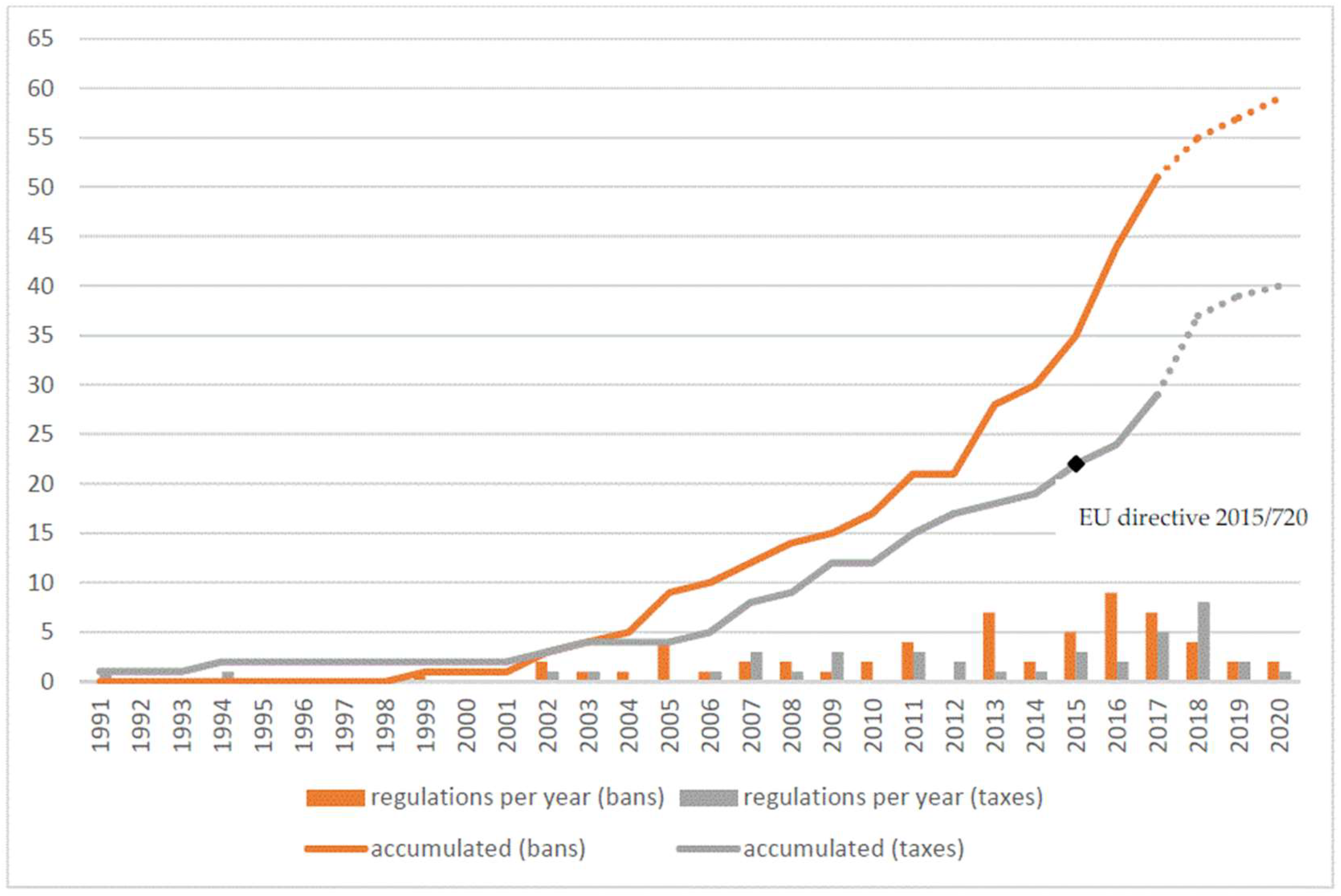

Sustainability Free Full Text Developing Countries In The Lead What Drives The Diffusion Of Plastic Bag Policies Html

Alborsanews Federal Reserve Monetary Policy Bond Market

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

The Downturn Persists Examiner Analysis Reveals That S F S Economy Has A Long Road To Recovery The San Francisco Examiner

Migration To Low Tax Metros Is Accelerating As More People Looked To Leave Expensive Coastal Areas In The Second Quarter Low Taxes Migrations Two By Two

California State Sales Tax 2018 What You Need To Know Taxjar

California Sales Tax Small Business Guide Truic

Sustainability Free Full Text Developing Countries In The Lead What Drives The Diffusion Of Plastic Bag Policies Html

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia